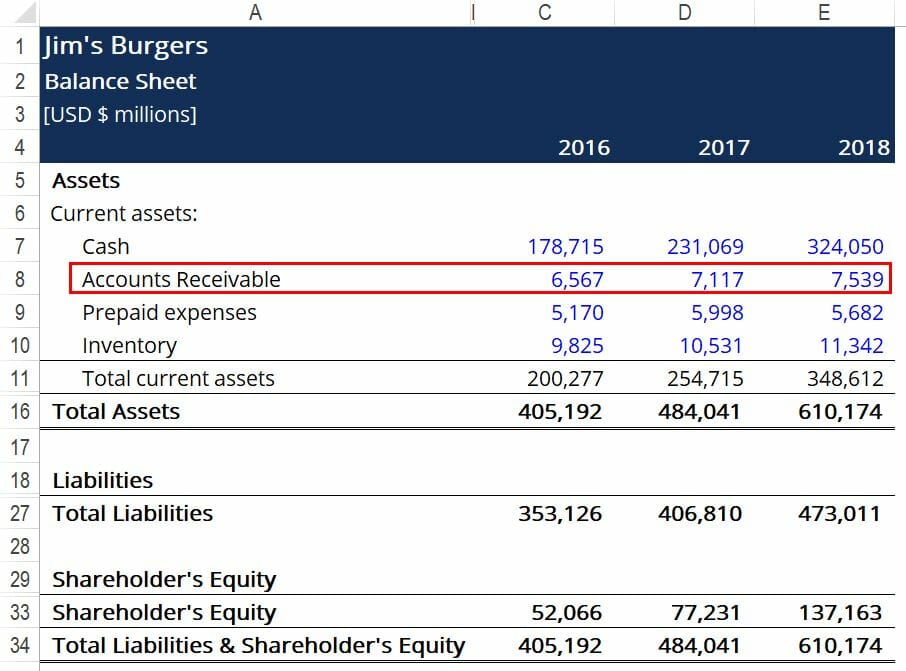

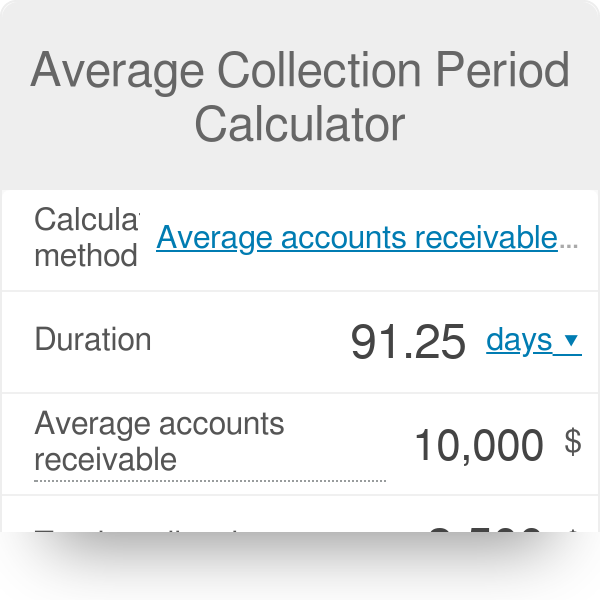

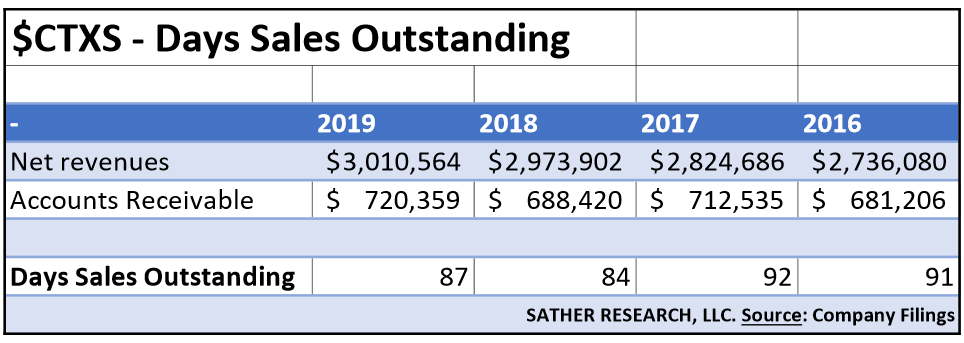

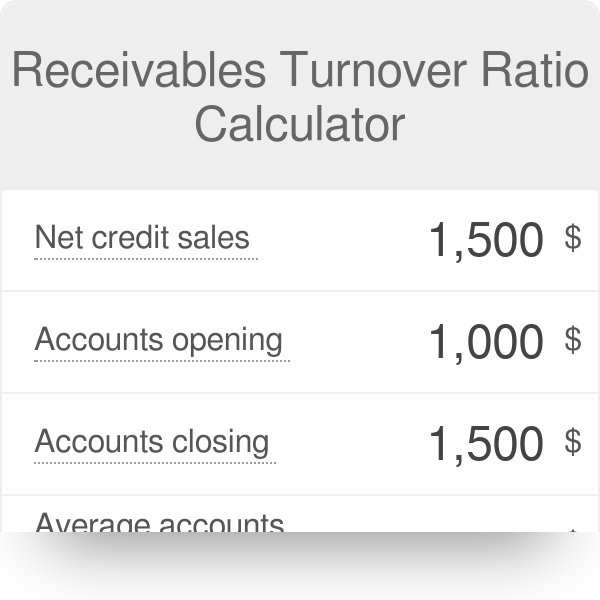

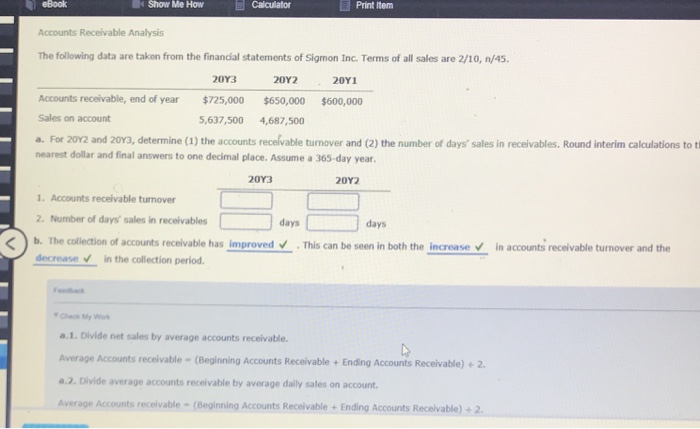

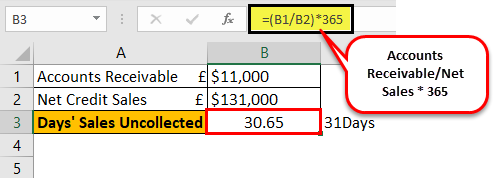

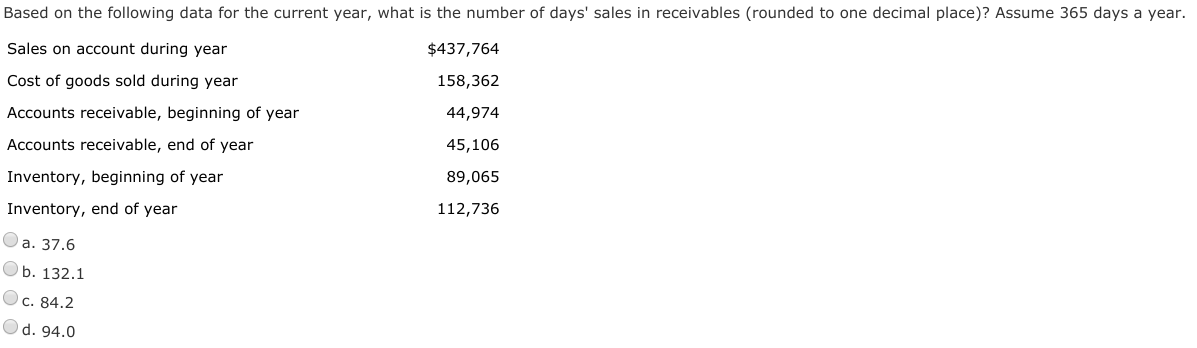

DSO = Accounts receivables/ Total credit sales x No of days = 4,00,000/7,00,000 x 31 = 177 days In my opinion, 177 days is a low average turnaround for a company to collect cash from accounts receivables in a month and hence portrays a good DSO however, it varies from company to company what they consider to be a high or low DSOWe can calculate the Average Collection period by using the below formula Average Collection Period = 365 Days /Average Receivable Turnover ratio For the second formula, we need to compute the average accounts receivable per day and the average credit sales per day During the last three months of the year, Company A made a total of $1500,000 in credit sales and had $1050,000 in accounts receivable The time period covers 92 days Company A's DSO for that

Days Sales In Receivables Example Youtube

Number of days sales in ending receivables formula

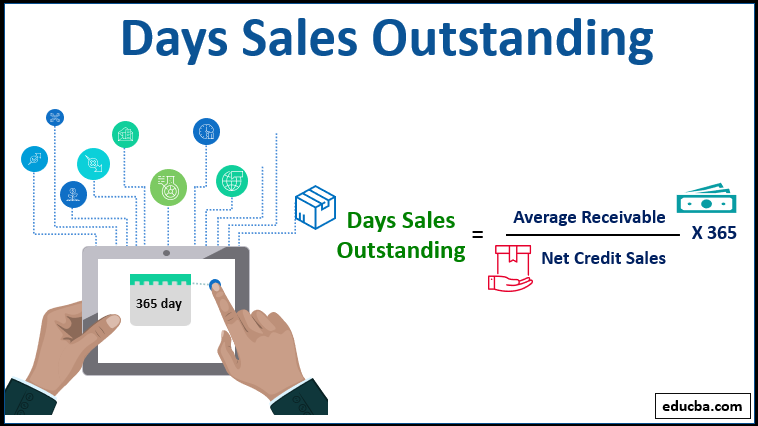

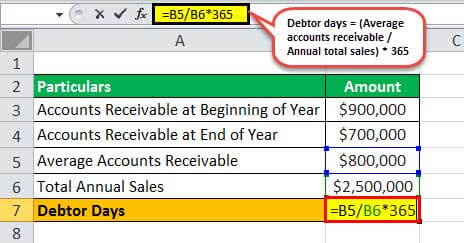

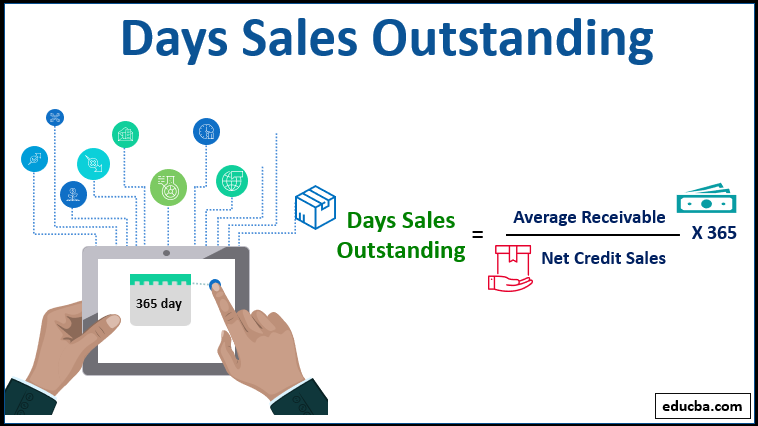

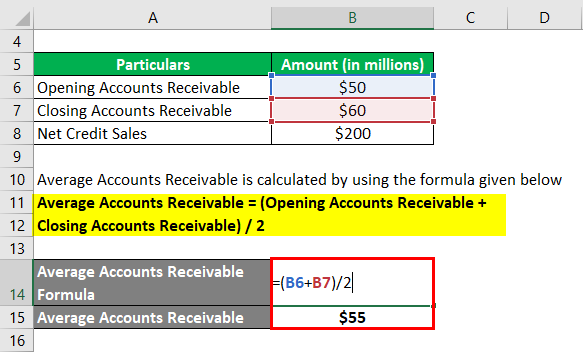

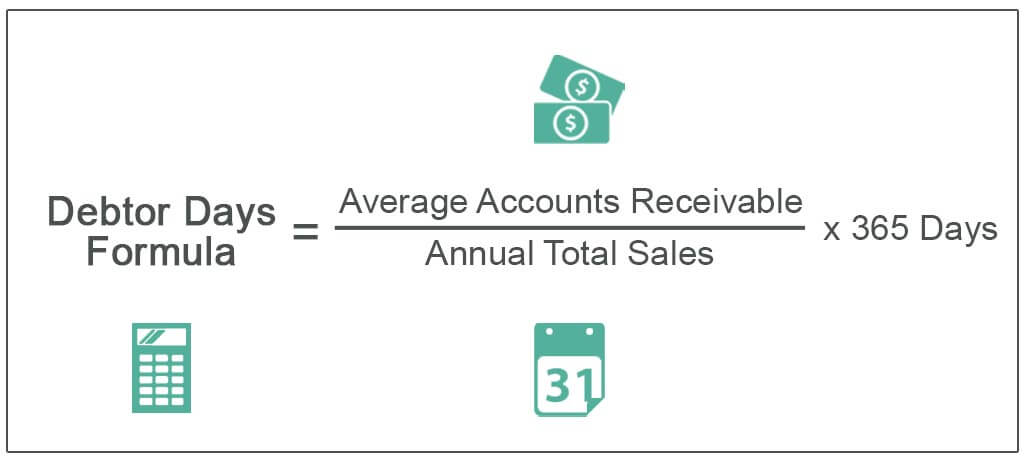

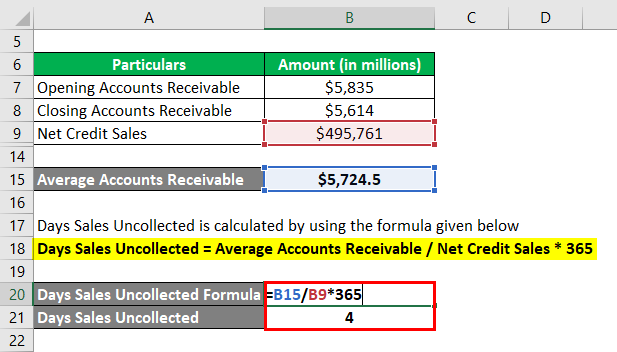

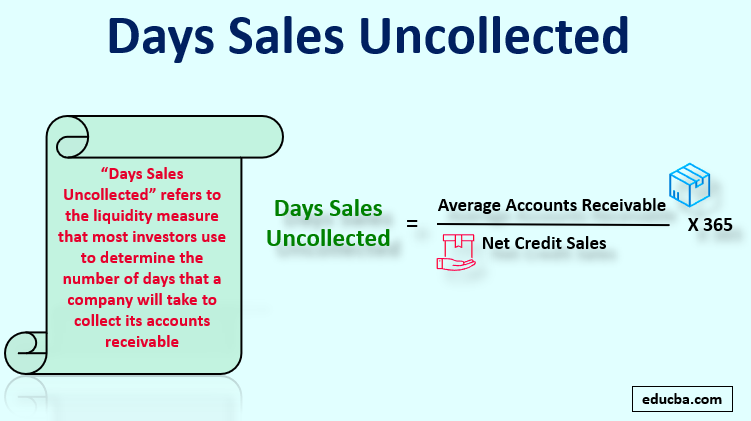

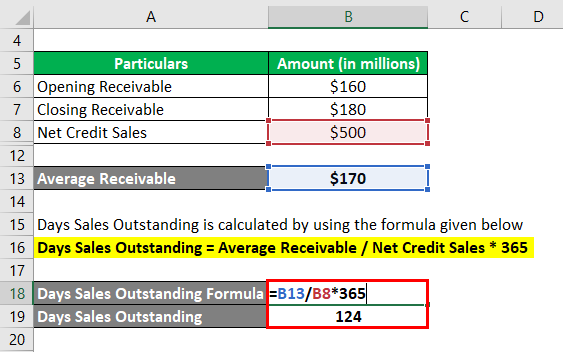

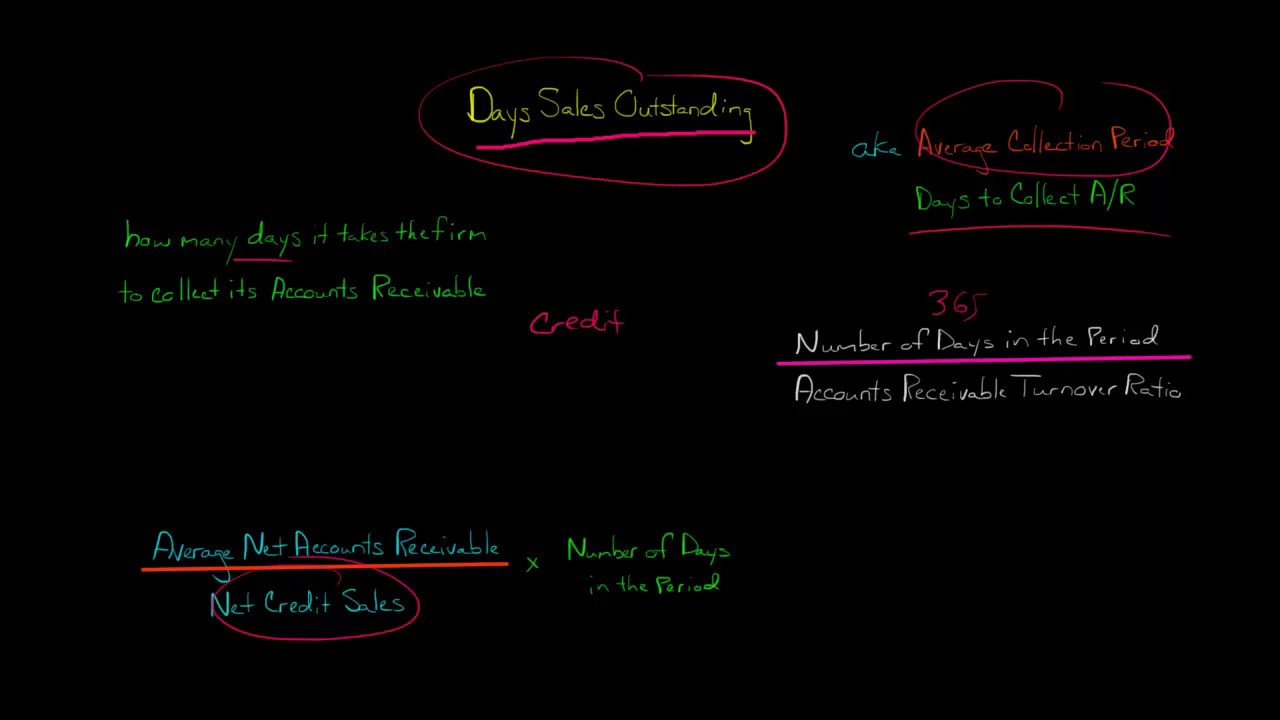

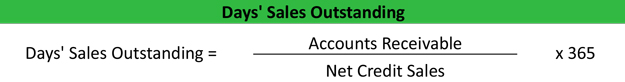

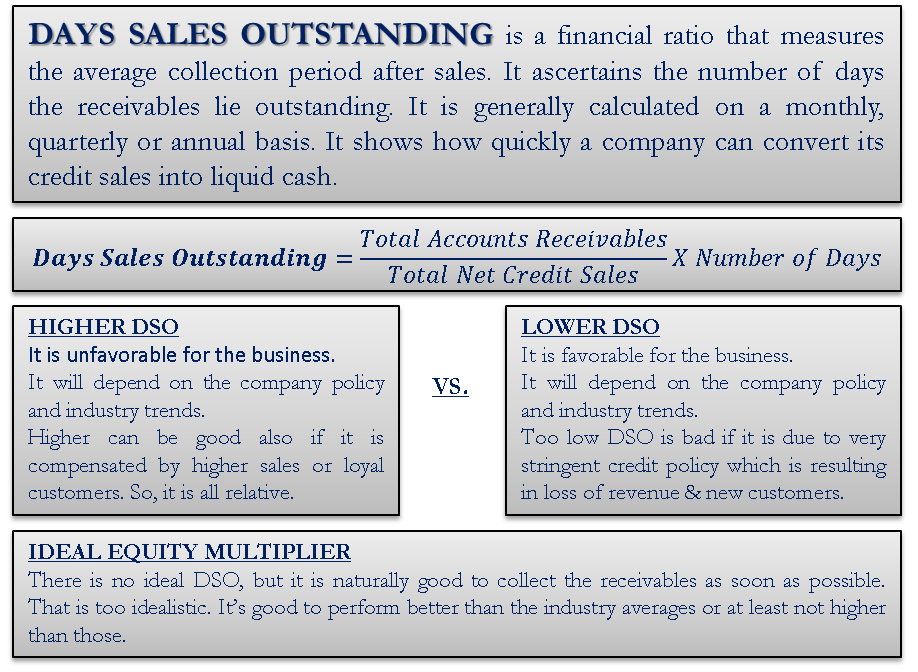

Number of days sales in ending receivables formula- Calculate number of days sales in receivables For instance if you are recording The number of days in the year use 360 or 365 divided by the accounts receivable turnover ratio during a past year x 365 5475 days That means it takes customers an average of 5475 days to pay their billsThe calculation of days sales outstanding (DSO) involves dividing the accounts receivable balance by the revenue for the period, which is then multiplied by 365 days DSO Formula Days Sales Outstanding (DSO) = (Average Accounts Receivable / Revenue) * 365 Days Let's say a company has an A/R balance of $30k and $0k in revenue

Days Sales Outstanding Examples With Excel Template Advantages

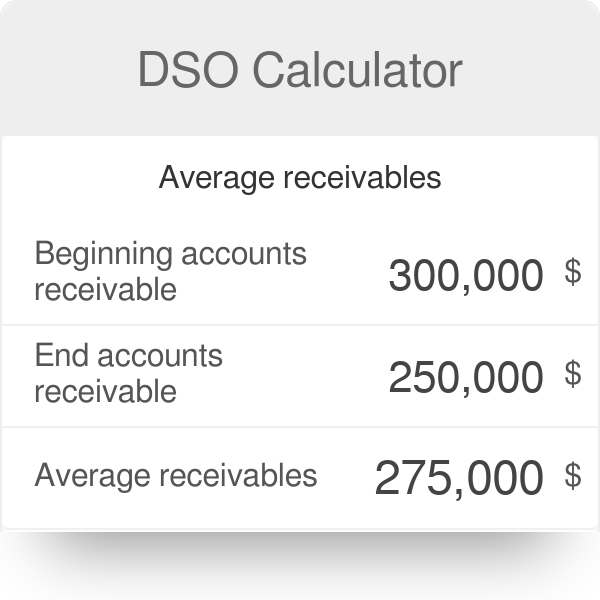

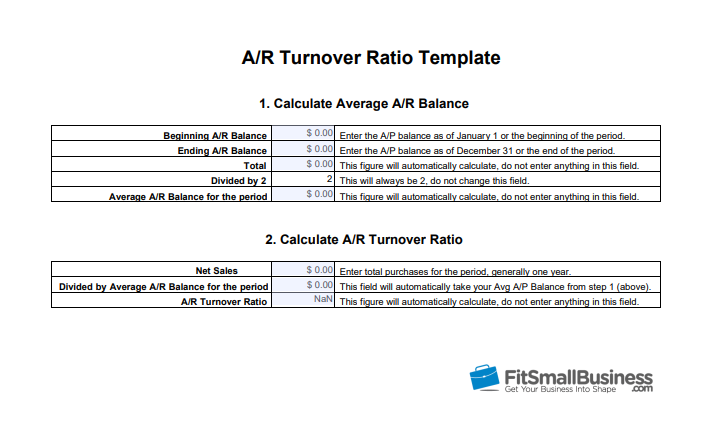

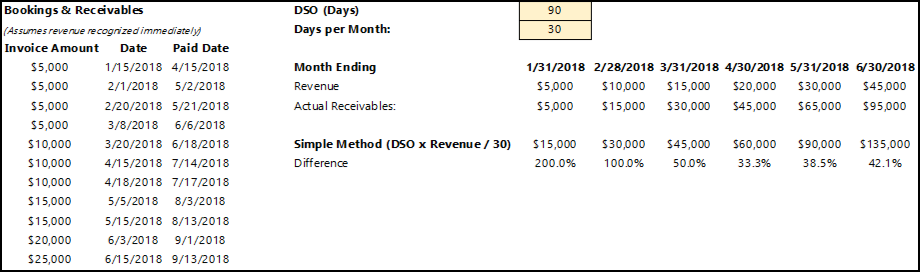

Day Sales Outstanding (DSO) can uncover the effectiveness of your credit and collection policy's effectiveness over time This version of a DSO calculator multiplies your current end of month receivables balance by 90 and divides that number by your total sales for the last 3 months The numerator in the number of days' sales in receivables calculation is aaccounts receivable ending balance baccounts receivable beginning balance caverage daily sales dNone of these choices are correctCalculate your total credit sales for the period — this is the amount of money you have invoiced your customers for during this period, this number is sometimes called your 'gross sales' Divide your accounts receivables by your total credit sales and multiply by the number of days in that period So, if you are calculating your annual

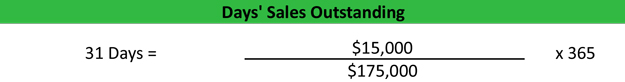

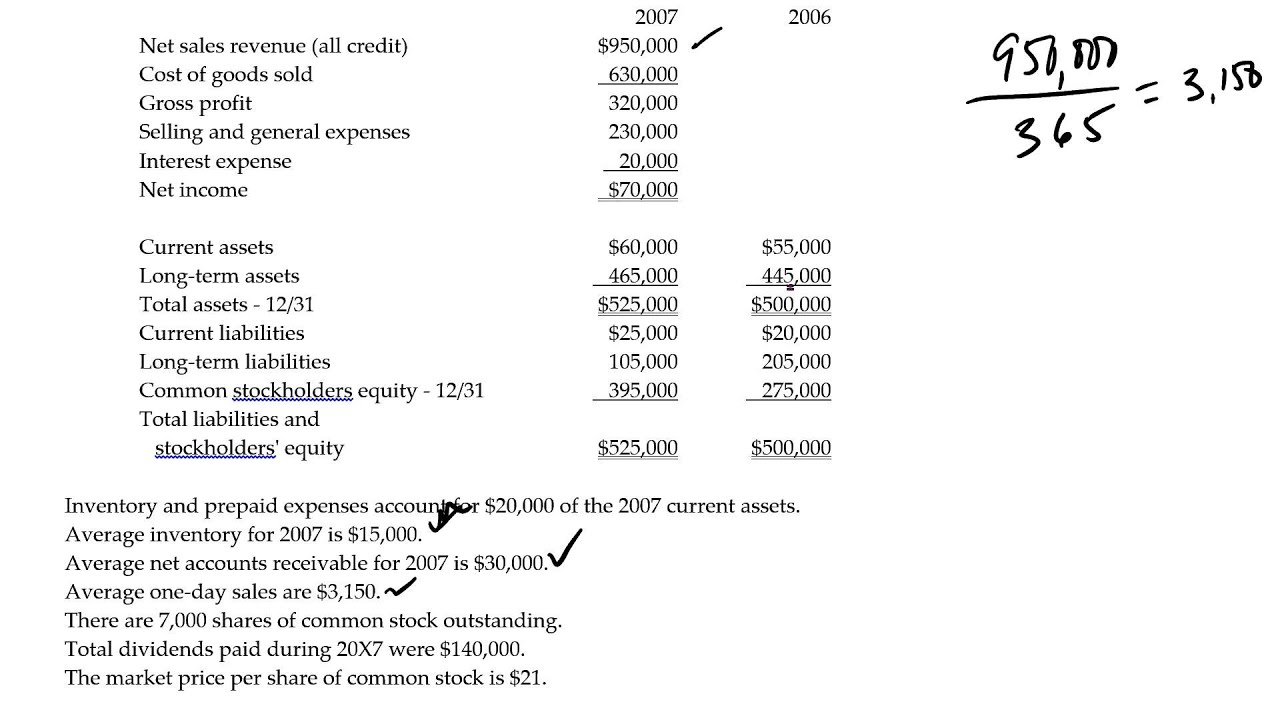

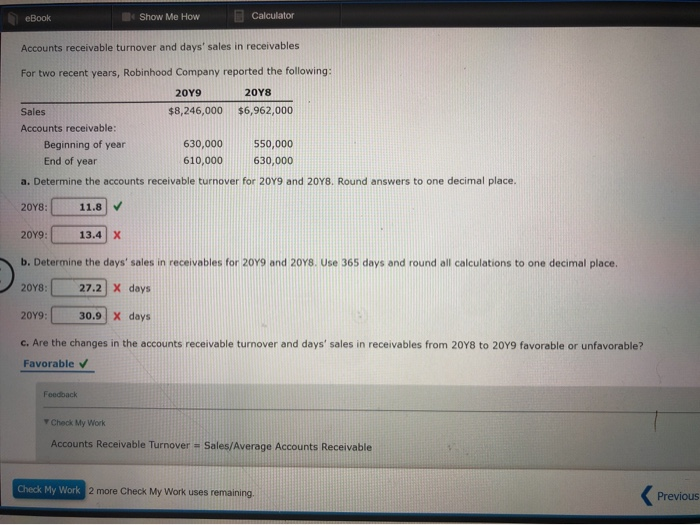

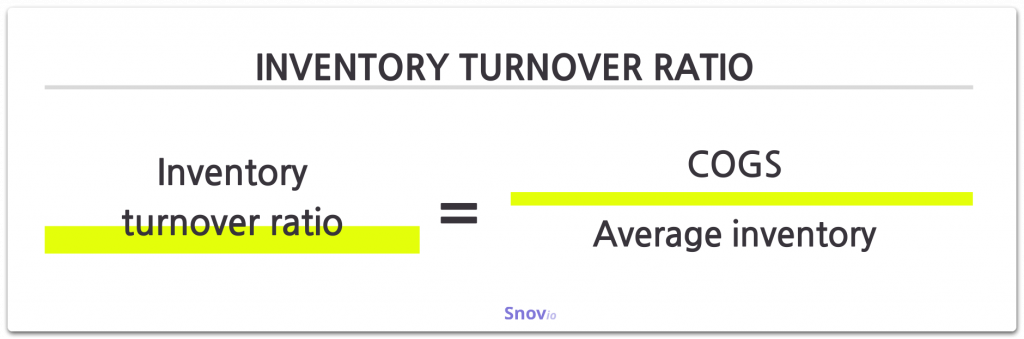

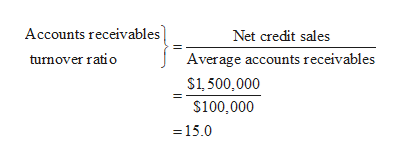

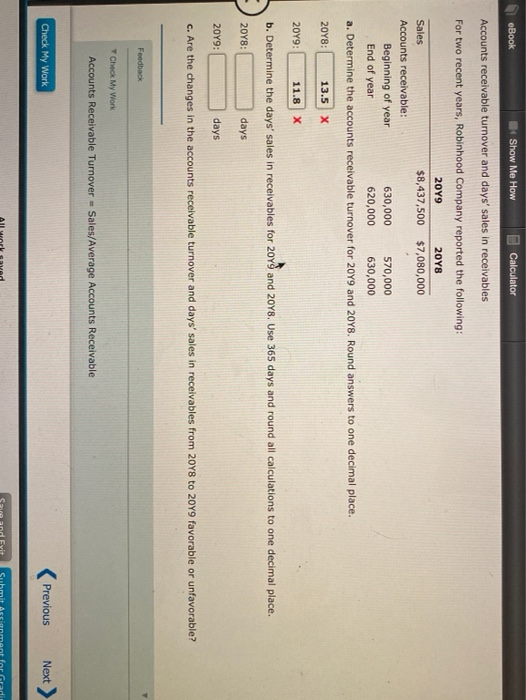

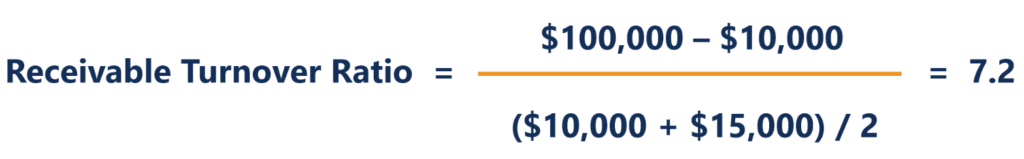

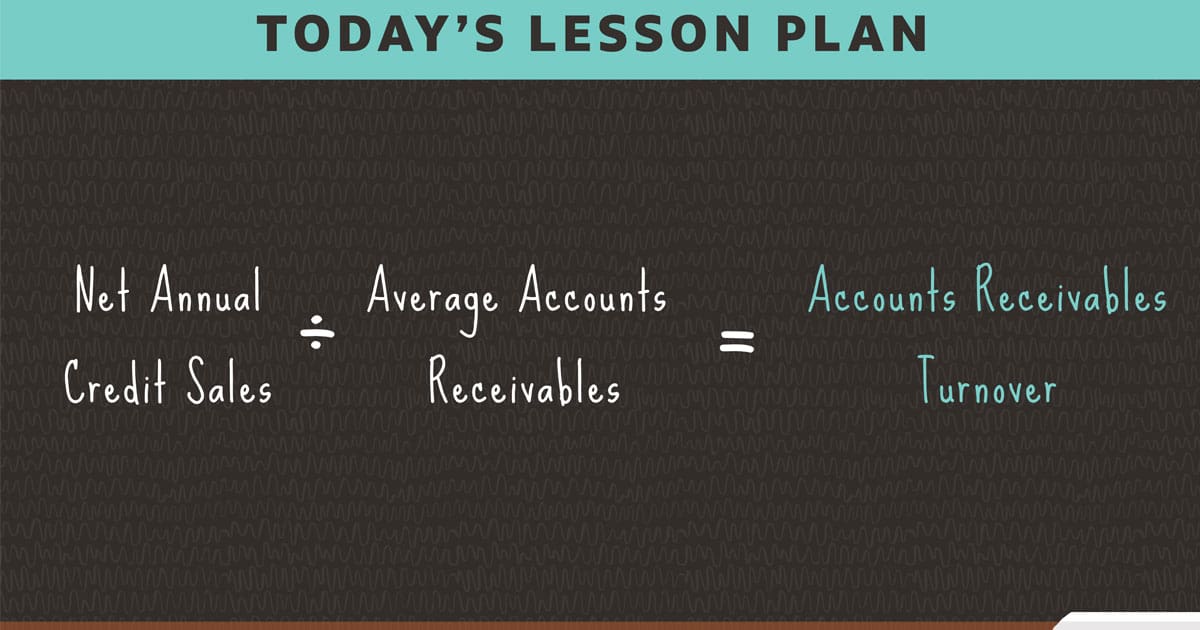

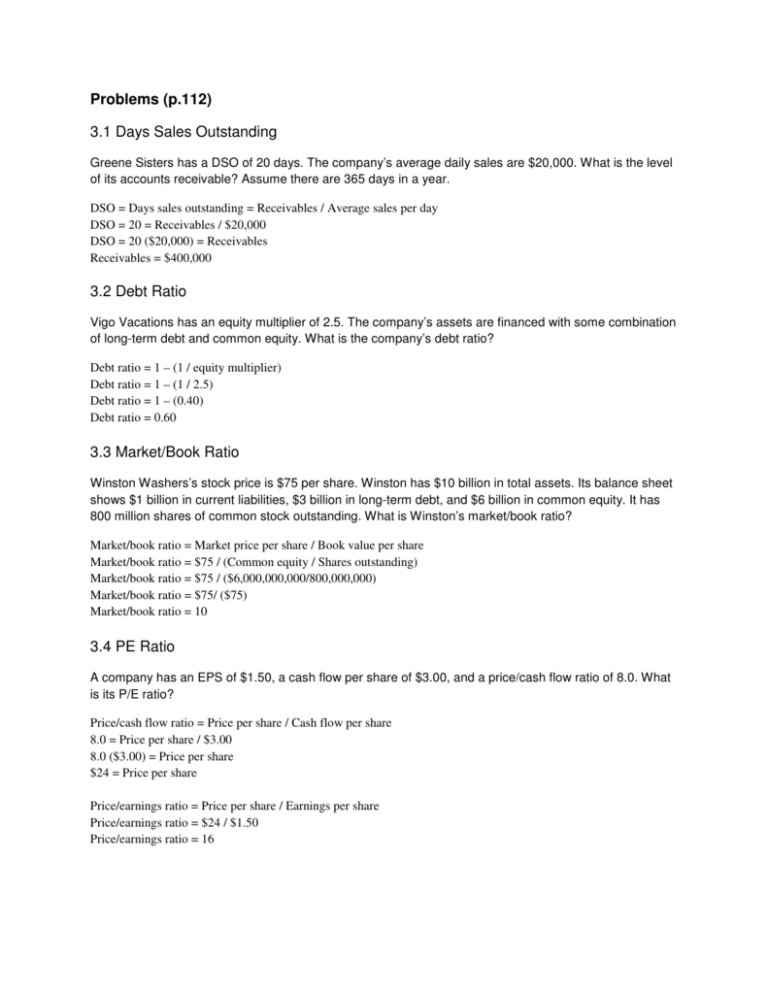

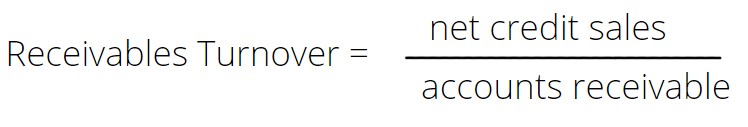

b Number of days' sales in receivables _____ days _____ Determine (a) the inventory turnover and (b) the number of days' sales in inventory Round interim calculations to the nearest dollar and final answers to one decimal place Assume 365 days a year A company reports the following Cost of goods sold $630,000 Average inventory 90,000 aDays Sales Outstanding = (Accounts Receivable/Net Credit Sales)x Number of days Example Calculation of DSO For instance, company A makes around $30,000 credit sales and $,000 accounts receivables in 40 daysCalculate accounts receivable turnover and number of days sales in receivables Accounts receivable turnover is the number of times per year a business collects its average accounts receivable The ratio is used to evaluate the ability of a company to efficiently issue credit to its customers and collect funds from them in a timely manner

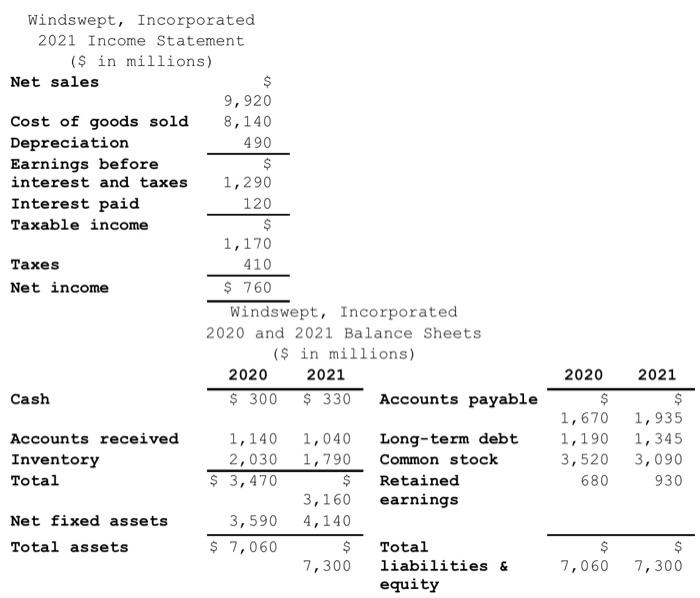

Calculating Days in A/R First, you'll need to calculate your practice's average daily charges Add all of the charges posted for a given period 3 months, 6 months, 12 months Divide the total charges, less credits received, by the total number of days in the selected period (eg, 30 days, 90 days, 1 days, etc)DSI = (Inventory / Cost of Sales) x (No of Days in the Period) Example For the yearend 15 financial statements , Target Corp reported an ending inventory of $1M and a cost of sales of $100M Given the figures, the DSI for the year is 365 days, meaning it takes approximately 4 days for the company to sell its stock of inventory Question Presented here are summarized data from the balance sheets and income statements of Wiper Inc

A Step By Step Guide To Calculating Days Sales Outstanding The Blueprint

Cash Conversion Cycle Overview Example Formula

DSO = (accounts receivable) / (total credit sales) x (number of days in given time period) In the formula, the accounts receivable is divided by the credit sales for a specified number of days, and then multiplied by that number of days The result is the days sales average, which can give insight into how a business generates cash flowImagine Company A has a total of £1,000 in their accounts receivable, along with an annual revenue of £800,000 Then, you can use the accounts receivable days formula to work out your total as follows Accounts Receivable Days = (1,000 / 800,000) x 365 = 5475 This tells us that Company A takes just under 55 days to collect a typical invoiceDays Sales Outstanding is often confused for "the time it takes to fully collect unpaid invoices" Mathematically, there is no direct relationship between DSO and the number of days it takes a company to get paid DSO is a measurement of the number of an average day's sales that are tied up in receivables awaiting collection

1

Days Sales Outstanding Dso Ratio Formula Calculation

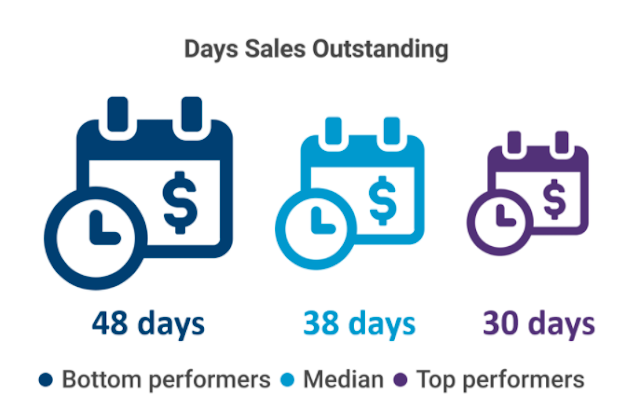

If you've been relying on the DSO calculation to monitor the performance of your receivables, this table should set off some very loud alarms in your head Here are how the DSO numbers are calculated for March 40 =30 days/per month * $400 AR / $300 average monthly sales 48 =30 days/per month * $400 AR / $250 average monthly sales Days Sales Of Inventory DSI The days sales of inventory value (DSI) is a financial measure of a company's performance that gives investors an idea of how long it Calculate days receivable The amount of time that elapses between a sale and receipt of payment for that sale provides information about the financial structure of a company, including how the company manages its receivables Calculating days receivable, or the average number of days sales are outstanding, is easy now with this calculator

Accounts Receivable To Sales Ratio How To Calculate The Ratio

Receivables Turnover Vs Days Sales Outstanding Dso What S The Difference Gaviti

The dayssalesoutstanding formula divides accounts receivable by total credit sales, multiplied by a number of days in a measurement period Your accounts receivable (A/R) is all outstanding payments owed to your company, and can be found by reviewing your balance sheet and income statementFormula The ratio is calculated by dividing the ending accounts receivable by the total credit sales for the period and multiplying it by the number of days in the period Most often this ratio is calculated at yearend and multiplied by 365 days Accounts receivable can be found on the yearend balance sheetDays' Sales in Inventory Calculator More about the Days' Sales in Inventory so you can better use the results provided by this solver The Days' Sales in Inventory is the ratio between 365 and the inventory turnover

1

Receeve 4 Ways To Reduce Your Company S Days Sales Outstanding Dso

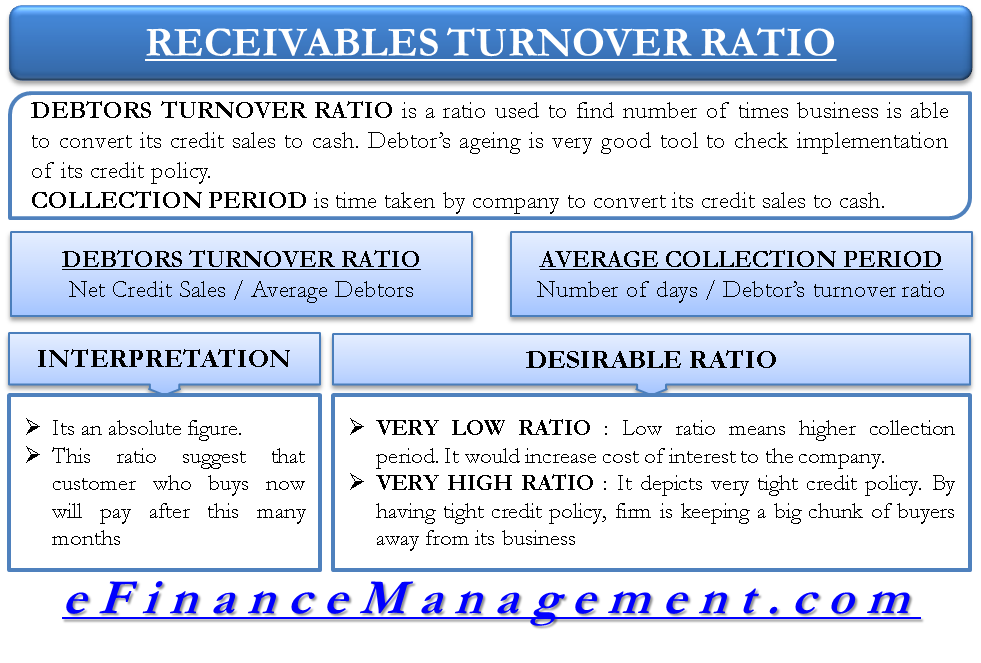

DSO (Days Sales Outstanding) is the average number of days it takes for a company to collect its accounts receivables This is quantified by how long it takes to convert credit sales to cash For instance, if the DSO of a company is 45 days, it means that they are able to collect back their past dues within 45 days, approximately Using the Days sales outstanding formula given above, Days sales outstanding = Total Accounts Receivables / Total Net Credit Sales x Number of Days = $ / $0000 x 30 = 15 days Thus, the DSO figure for Carl & Dan International Limited is 15 days This implies that the company takes around 15 days to collect its accounts receivablesNow, once we have the receivables turnover, we compute the Days' Sales in Receivables using \text {Days' Sales in Receivables} = \displaystyle \frac {365} {Receivables Turnover} Days' Sales in Receivables = ReceivablesT urnover365 A related measure to days sales in receivables is the receivables turnover , so you may want to compute that as well

Debtor Days Meaning Formula Calculate Debtor Days Ratio

Days Sales Outstanding Dso Formula And Excel Calculator

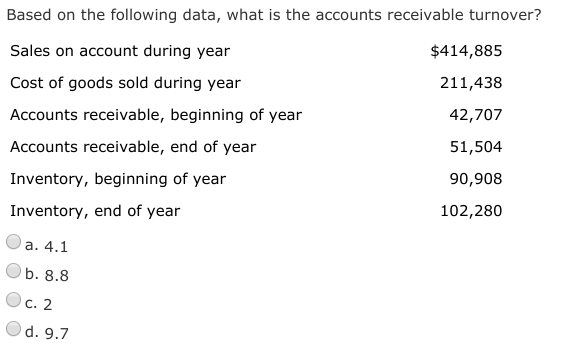

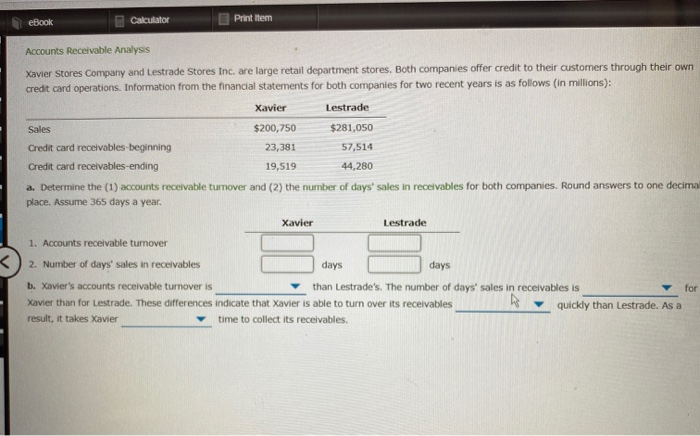

Calculate the number of days sales in receivables for the two companies using from ACCOUNTING TAX 00 at South Florida State CollegeAssume that accounts receivable at , totaled $321 million Calculate the number of days' sales in receivables at that date i Calculate Wiper's debt ratio and debt/equity ratio at and 19 j Calculate the times interest earned ratio for and 19 Get Quote for Fresh Answers (Without Plagiarism)A company reports the following Sales $433,6 Average accounts receivable (net) 24,090 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables Round interim calculations to the nearest dollar and final answers to one decimal place Assume a 365day year a Accounts receivable turnover b

Ebook Calculator Print Item Accounts Receivable Analysis Xavier Stores Company And Lestrade Stores Inc Are Large Homeworklib

Have Not Been Able To Calculate 11 12 And 15 Ebook Calculator Measures Of Liquidity Solvency Homeworklib

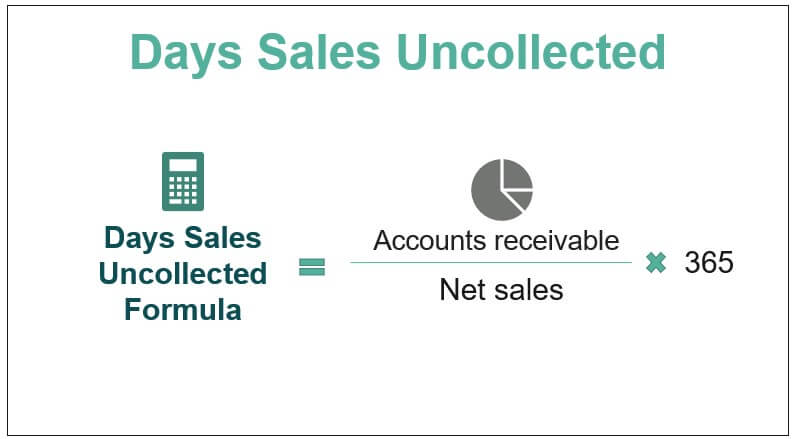

To calculate your DSO, determine the length of time you would like to analyze We recommend at least three months to get an accurate average Insert your accounts receivable from the balance sheet and net sales over the period from your income statement, and then select the window of time you'd like to analyze Days Sales Outstanding is also called the average collection period or days' sales in receivables, measures the number of days it takes a company to collect cash from its credit sales Alternatively, it displays how well a company can collect cash from its customers Formula – How to calculate Days of Sales Outstanding Days of Sales Outstanding = Accounts Receivable / (Annual Sales / 365) Example A company has accounts receivable of $3,000 and annual sales of $16,000 Days of Sales Outstanding = $3,000 / ($16,000 / 365) = $3,000 / $436 = 6845 Therefore, this company has 685 days of sales outstanding

Days Sales In Receivables Calculator Mathcracker Com

Tutor2u Debtor Receivable Days

The days' sales in accounts receivable can be calculated as follows the number of days in the year (use 360 or 365) divided by the accounts receivable turnover ratio during a past yearThe accounts receivables days measure the business's ability to collect shirt term payments effectively, in a timely manner The formula used to calculate account receivable days is applied to the total payments due to be collected from the customers rather than for anyone invoice due from a customer in particular (Accounts Receivable/ Total Sales) x Number of Days = DSO For example, if you wanted to calculate the annual DSO for a business with $225M in it's A/R balance sheet and $150M in total sales, the formula would look like this ($22,500,000 / $150,000,000) x 365 = 5475 days That means it takes customers an average of 5475 days to pay their bills

What Is Accounts Receivable Turnover Definition And More Billtrust

Days Sales Outstanding Calculator Plan Projections

View Calculate the number of days sales in receivables Round to one decdocx from ACCOUNTING BALANCE SH at Dhaka City College Calculate the number of days' sales in receivables Round to one The formula for days sales outstanding is to divide accounts receivable by the annual revenue figure and then multiply the result by the number of days in the year The formula is as follows (Accounts receivable ÷ Annual revenue) × Number of days in the year = Days sales outstanding Example of Days Sales Outstanding Receivable days represent the number of days customers are taking to pay a company for its sales We calculate receivable days using the following formula = 365 / (Sales / average of trade receivables outstanding at the start of

Average Collection Period Calculator

Days Sales Outstanding Dso Formula And Excel Calculator

ABC Group number of days' sales in receivables ratio 365 / 3 = 112 123 Company number of days' sales in receivables ratio 365 / 3 = 97 To decide, which company I would invest, first I need to analyze these ratios The accounts receivable turnover ratio shows, the rate of repayment of the receivables of the organization,Days Sales in Inventory Calculator calculate a firm's days sales in inventory which is the number of days it will take the firm to sell all of its inventoryQuestion Calculator Days' sales in receivables a measures the number of times the receivables turn over each year Ob is credit sales divided by average receivables Oc is an estimate of the length of time the receivables have been outstanding Od is

Days Sales In Receivables Example Youtube

Credit Period Definition Formula Example Of Credit Period

Divide the credit sales by 365 In the example, $1 million divided by 365 equals $2, per day These are the credit sales per day Divide the ending accounts receivable by the credit sales per day to find the average days in receivables In the example, $500,000 divided by $2, per day equals 15 days References If a company has an average accounts receivable balance of $0,000 and annual sales of $1,0,000, then its accounts receivable days figure is ($0,000 accounts receivable ÷ $1,0,000 annual revenue) x 365 days = 608 Accounts receivable days The calculation indicates that the company requires 608 days to collect a typical invoiceDays Sales Outstanding Formula Meaning Example And Interpretation The numerator in the number of days' sales in receivables calculation is The numerator in the number of days' sales in receivables calculation is

Days Sales Outstanding Examples With Excel Template Advantages

What Is Dso Why Dso Is Vital For Accounts Receivable Billtrust

DSO = Accounts Receivables / Net Credit Sales X Number of Days Example Calculation George Michael International Limited reported a sales revenue for November 16 amounting to $25 million, out of which $15 million are credit sales, and the remaining $1 million is cash sales The accounts receivable balance as of monthend closing is $800,000

Solved Accounts Receivable Turnover And Days Sales In Chegg Com

How To Calculate Days Sales Outstanding Aka Dso Calculation Paysimple

Days Sales Uncollected Different Examples With Limitations

Debtor Days Meaning Formula Calculate Debtor Days Ratio

What Is Sales Turnover Definition And Ratio Formulas Snov Io

Solved Based On The Following Data For The Current Year Chegg Com

How To Calculate Average Net Receivables Universal Cpa Review

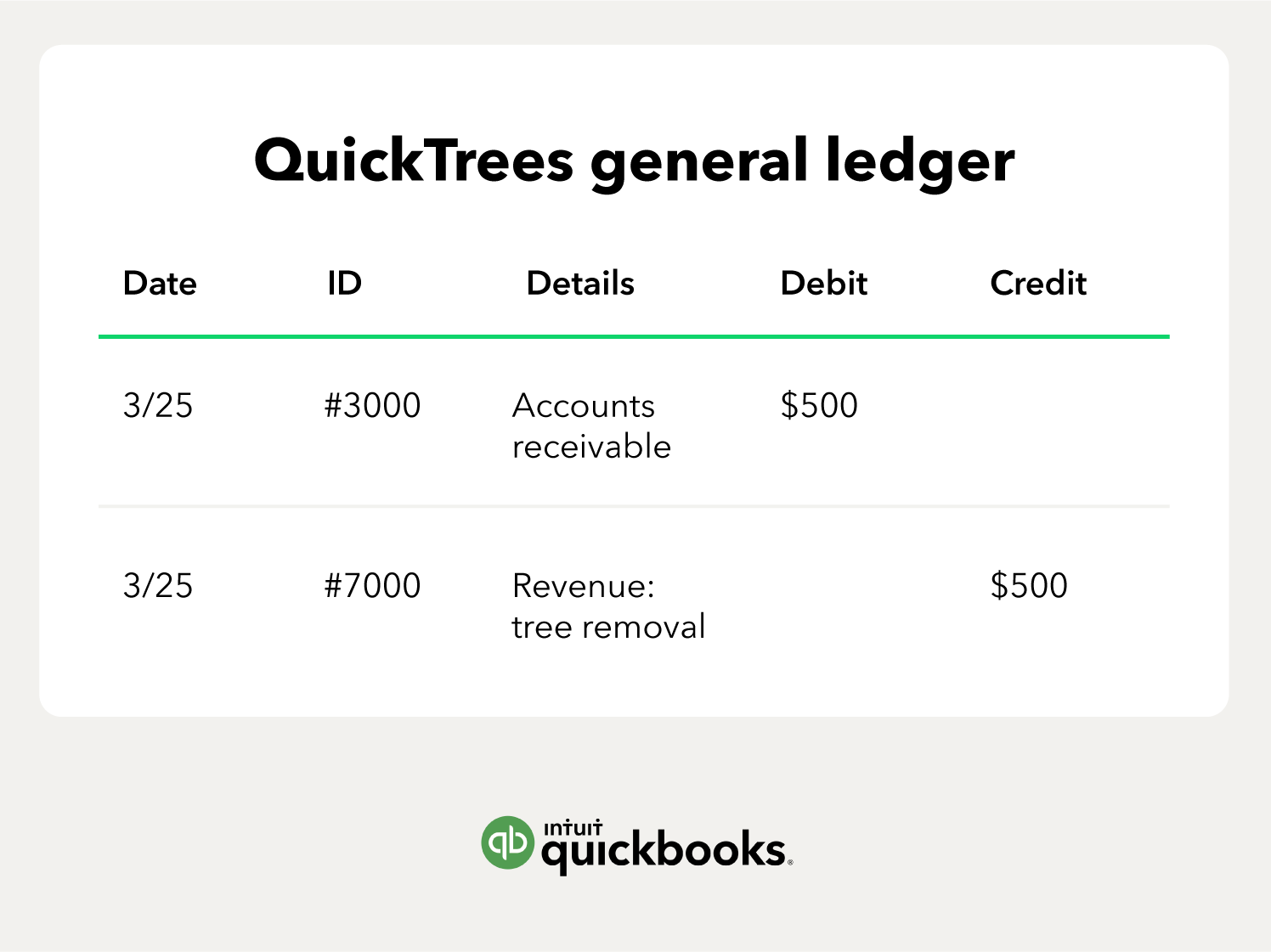

What Are Accounts Receivable Article

What Is Accounts Receivable Turnover Definition And More Billtrust

Ebook Calculator Print Item Accounts Receivable Analysis Xavier Stores Company And Lestrade Stores Inc Are Large Homeworklib

Answered A Company Reports The Following Sales Bartleby

Calculator Days Sales In Receivables A Measures The Number Of Times The Receivables Turn Over Each Homeworklib

Average Collection Period Calculator Calculator Academy

Solved Ebook Calculator Print Item Accounts Receivable Chegg Com

Measure And Manage Collection Efficiency Using Dso Abc Amega

Continuing Company Analysis Amazon Accounts Receivable Turnover And Number Of Days Sales In Receivables Amazon Com Is One Homeworklib

Receivable Turnover Ratio Formula Calculate Interpretation Benchmark

Solved Use The Statements Below To Answer The Following Chegg Com

Days Sales Outstanding Examples With Excel Template Advantages

Receeve 4 Ways To Reduce Your Company S Days Sales Outstanding Dso

What Is The Receivables Turnover Ratio Fourweekmba

Days Sales Outstanding Meaning Formula Calculate Dso

Working Capital Adjustments Thought Sumproduct Are Experts In Excel Training Financial Modelling Strategic Data Modelling Model Auditing Planning Strategy Training Courses Tips Online Knowledgebase

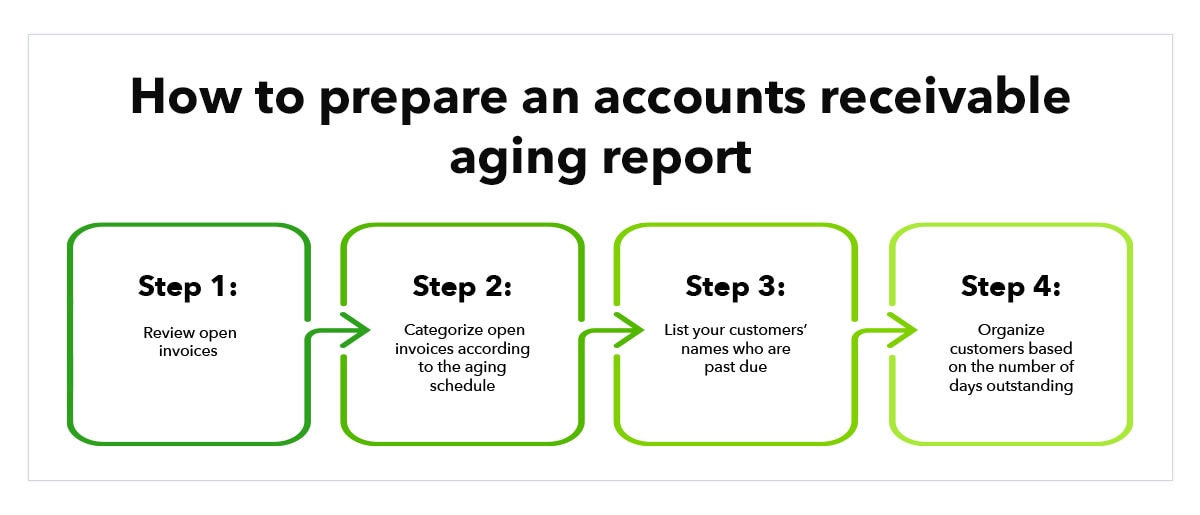

Accounts Receivable Aging Report In Excel Magnimetrics

Days Sales In Receivables Ratio Days Sales Outstanding Explained Formula Guidance Youtube

Days Sales Outstanding Calculator Abcadda

Finance Ratio The Dso Calculation With Average Dso For The S P 500

What Is An Accounts Receivable Aging Report And How Do You Use One Article

11 Tips To Improve Your Accounts Receivable Turnover Enkel

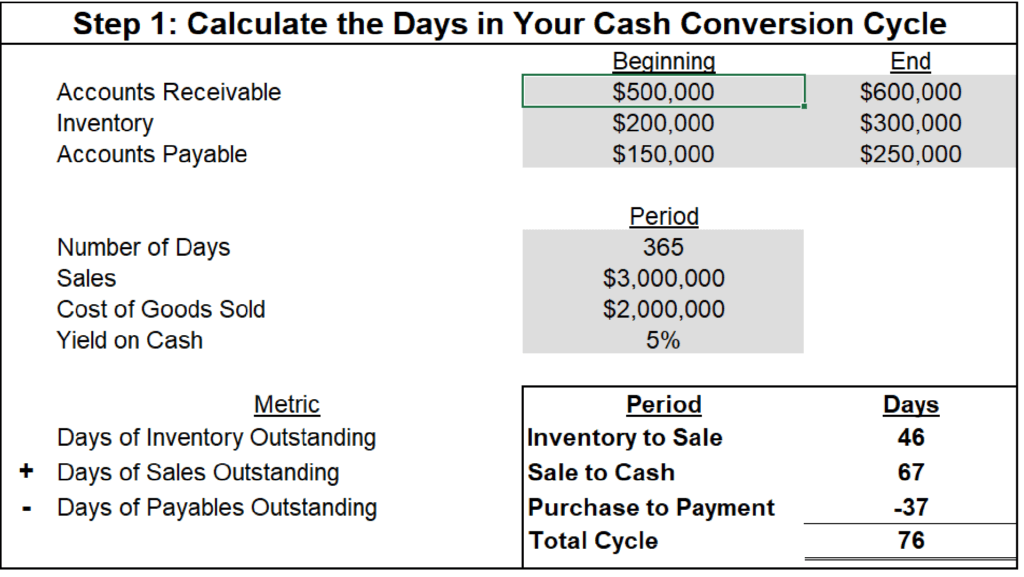

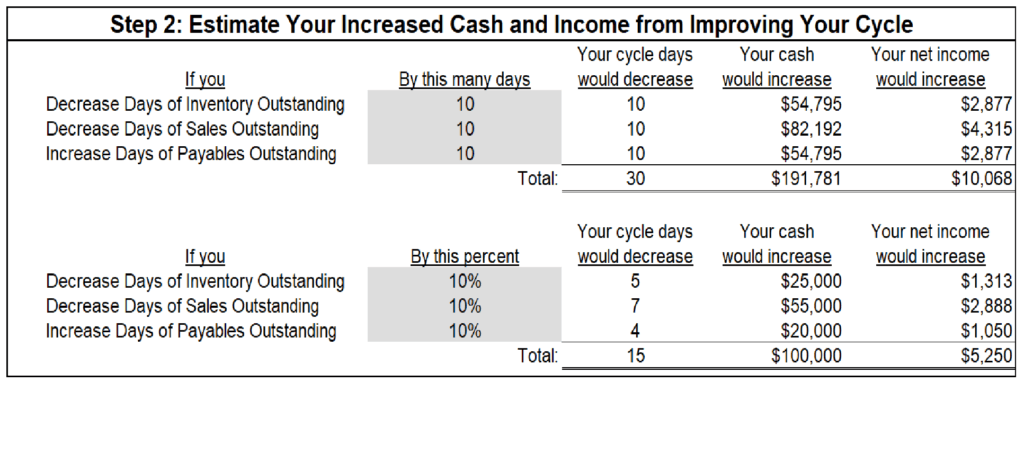

What Is Cash Conversion Cycle And How To Calculate Portal Educando

Cash Conversion Cycle Ccc Formula And Excel Calculator

Solved Ebook Show Me How Calculator Accounts Receivable Chegg Com

Forecasting Balance Sheet Items Financial Modeling Guide

How To Calculate Your Days Sales Outstanding In Quickbooks Calculator

/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

Calculating The Cash Conversion Cycle Ccc

The Short Cash Cycle How To Cut Crunches And Grab More Growth

Average Collection Period Overview Importance Formula

Day Sales Outstanding Formula Calculator Scalefactor

Calculator Nineteen Measures Of Solvency And Profitability The Comparative Financial Statements Of Blige Inc Are As Homeworklib

/Balance-Sheet-for-Tutorial-copy-image_01-56a0a3303df78cafdaa37e61.png)

Financial Ratio Analysis Tutorial

Dso How To Calculate Days Sales Outstanding Why It Matters

Accounts Receivable To Sales Ratio How To Calculate The Ratio

Measuring Days Sales Outstanding Dso Calculator

Answered In 22 Blossom Company Has Net Credit Bartleby

Days Sales In Receivables Calculator Mathcracker Com

Accounts Receivable Turnover Ratio Formula Examples

Days Sales Uncollected Different Examples With Limitations

Days Sales Outstanding Dso Formula And Excel Calculator

The Short Cash Cycle How To Cut Crunches And Grab More Growth

Continuing Company Analysis Amazon Accounts Receivable Turnover And Number Of Days Sales In Receivables Real World Homeworklib

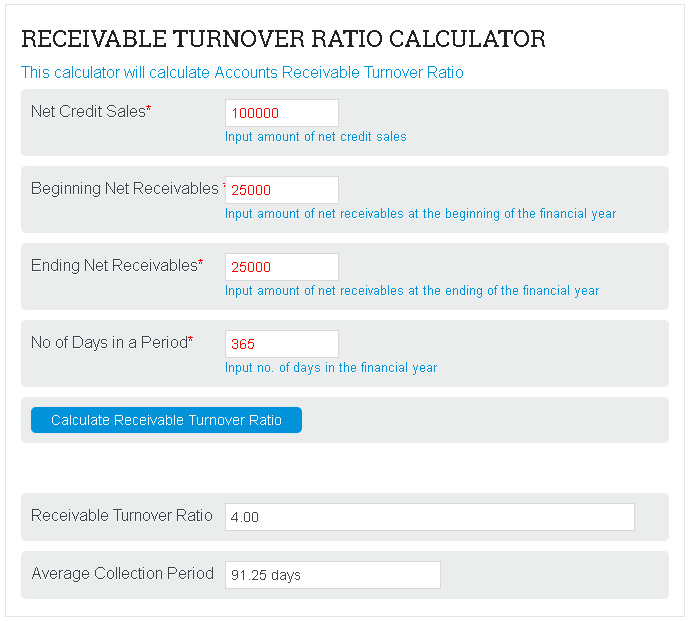

Receivable Turnover Ratio Calculator Efinancemanagement

1

Days Sales In Receivables Example Youtube

Average Collection Period What It Is And How To Calculate It Quickbooks

Measure And Manage Collection Efficiency Using Dso Abc Amega

Days Sales Outstanding Dso Formula And Excel Calculator

Accounts Receivable Turnover Ratio Definition Formula Examples Netsuite

Measure And Manage Collection Efficiency Using Dso Abc Amega

Accounts Receivable Turnover Ratio Formula Examples

Receivables Turnover Ratio Calculator

Solved Ebook Show Me How Calculator Print Item Accounts Chegg Com

Days Sales Outstanding Examples With Excel Template Advantages

Days Sales Outstanding Average Collection Period Youtube

Days Sales Outstanding Dso Ratio Formula Calculation

Dso Calculator Calculate Days Sales Outstanding

1

3 1 Days Sales Outstanding

How To Determine Days Sales Outstanding Plan Projections

Ultimate Guide For Reducing Dso Peakflo

How To Calculate Credit Sales Incomplete Accounting Records Trade Receivables Debtors Youtube

3 Ways To Calculate Credit Sales Wikihow

Days Sales Outstanding Define Formula Calculate Analysis Ideal Dso

11 Tips To Improve Your Accounts Receivable Turnover Enkel

Working Capital Adjustments Thought Sumproduct Are Experts In Excel Training Financial Modelling Strategic Data Modelling Model Auditing Planning Strategy Training Courses Tips Online Knowledgebase

Accounts Receivable Turnover Ratio Definition How To Use It

Day S Sales Uncollected Formula Step By Step Calculation Examples

:max_bytes(150000):strip_icc()/latex_def61645733d74173000afc57e0173a6-5c7037d346e0fb0001f87ca5.jpg)

Days Sales Outstanding Dso Definition

A Better Way To Model Accounts Receivable And Accounts Payable By Dave Lishego Medium

Receivables Turnover Vs Days Sales Outstanding Dso What S The Difference Gaviti

Solved Based On The Following Data For The Current Year Chegg Com

Day S Sales Uncollected Formula Step By Step Calculation Examples

Accounts Receivable Turnover Days

0 件のコメント:

コメントを投稿